- A new space race driven by government ventures and commercial interest.

- The technological shift: from large systems to satellite constellations.

- With LEO, cost is key to ensure profitability and long-term viability.

- The journey from GEO to LEO begins as early as in the design process.

- Getting it right the first time with Design for Excellence (DFX).

- From New Product Introduction (NPI) to volume satellite manufacturing.

Over the last decade, the space industry has been launched into a new era – or rather a new orbit. While historically, satellites have consisted of primarily large systems in the Geosynchronous Equatorial Orbit (GEO), space investment has shifted. Now, smaller and less expensive Low Earth Orbit (LEO) satellites are taking to the skies. Success in this booming market hinges on space technology companies’ ability to cut costs substantially and ramp quickly to high volume satellite manufacturing.

Investment in space technologies as a critical infrastructure has been on an upward trajectory for some time and there is no slowdown in sight. In the first quarter of 2022 alone, venture capital firm Space Capital reported there was an equity investment of $7.2B in 118 space companies. Over the last ten years, over a quarter trillion dollars ($264.0B) of equity investment were made into 1,727 unique companies in the space economy.

A new space race driven by government ventures and commercial interest.

The booming market is driven by government activities and commercial interest, starting a new space race between companies to get products into the market quickly and be the most commercially viable. As the geopolitical situation intensifies, space itself has become a critical domain and agencies such as the U.S. Space Force and Space Defense are reinforcing their initiatives to protect space technologies such as GPS and communications satellites.

On the commercial side, COVID-19 has made it clear that without internet connectivity, the (business) world might as well stop turning. Demand for bandwidth is at an all-time high and investment in any kind of new connectivity infrastructure is essential for the ubiquitous digital transformation. Tech companies now have creative business models in place to generate profits from connectivity, driving investment further and enabling larger satellite constellations.

In fact, space operations have never previously occurred on this scale before. It’s a vibrant market with a new wave of space pioneers – from established industry players to innovative start-ups to global corporations trying to get a hold in a multi-billion dollar market.

Furthermore, this vibrant and growing space economy also raises concern. As global reliance on satellite services and applications grow, the importance of policies, practices, and technologies to use space sustainably becomes more critical. The international space community, including The American Institute of Aeronautics and Astronautics (AIAA) and private satellite operators, are devoted in finding technical solutions and best practices that span the design, launch, orbital operations and disposal for low earth orbit operations — ensuring the long-term sustainability for space activities for generations to come.

The technological shift: from large systems to satellite constellations.

To understand what’s happening on the business side, it’s worth looking at the evolution of space technology and the advances that have been made in recent years. Historically, ventures in satellite communications revolved primarily around the Medium Earth Orbit (MEO) or the Geosynchronous Equatorial Orbit (GEO). Following earth’s 24-hour orbital cycle from an altitude of more than 35,000 kilometers, only a small number of these satellites are needed to cover most of the planet’s surface. And while these satellites are large, highly complex and with a long service life from 10-15 years, they are also very costly.

That’s why, over the past ten years, the space industry has shifted its interest to satellites for Low Earth Orbit (LEO). Compared to their MEO or GEO counterparts, LEO satellites sit closer to the earth (500 to 2,000 kilometers), are much smaller and have a shorter lifespan. To ensure the same kind of coverage, they are usually launched in constellations, providing higher bandwidth per user and high-speed, low-latency communications.

The growing popularity of LEO is additionally driven by another factor: They are much less expensive. Launch costs are lower, as smaller and cheaper spacecraft can transport the satellites to LEO, opening space as a viable market to more companies and nations. Instead of having a satellite in orbit for 10 or 15 years, the duration of LEO satellite missions will only last three to five years. This gives companies the opportunity to continuously introduce new technology, make the systems more robust as time goes on and extend their connectivity services – and by that, their market footprint. On the geopolitical side, it also helps nations mitigate the risk of cutting off vital communications via the obliteration of one larger GEO satellite by an outside threat.

The shift from large and costly GEO satellites to smaller LEO satellite constellations is also a shift from handcrafted and customized systems to mass production and automation. It will and has already changed satellite operations, including manufacturing and the supply chain. Many satellite companies have been building the GEO space hardware for a long time, either in-house or with another prime contractor. And because the GEO environment presents higher requirements regarding the satellite components – especially the radiation levels of that particular orbit – a lot of additional testing has always been required. With LEO, all of this changes.

With LEO, cost is key to ensure profitability and long-term viability.

The key question from an engineering and manufacturing point of view is: How can large LEO-constellation providers make their prices competitive and ensure profitability and long-term viability? While LEO satellites do not have the same radiation requirements and the same supply chain complexity, there is still significant cost pressure. Mission life isn’t as long and companies need to build more satellites, faster. Overall, LEO requires a quick time-to-market as well as the scalability to higher volume production. So, to make LEO constellations financially viable, manufacturers need to cut costs across the whole value chain – starting early on in the design and development stage to automated manufacturing and testing to smart supply chain solutions. This is where Plexus Corp. comes in.

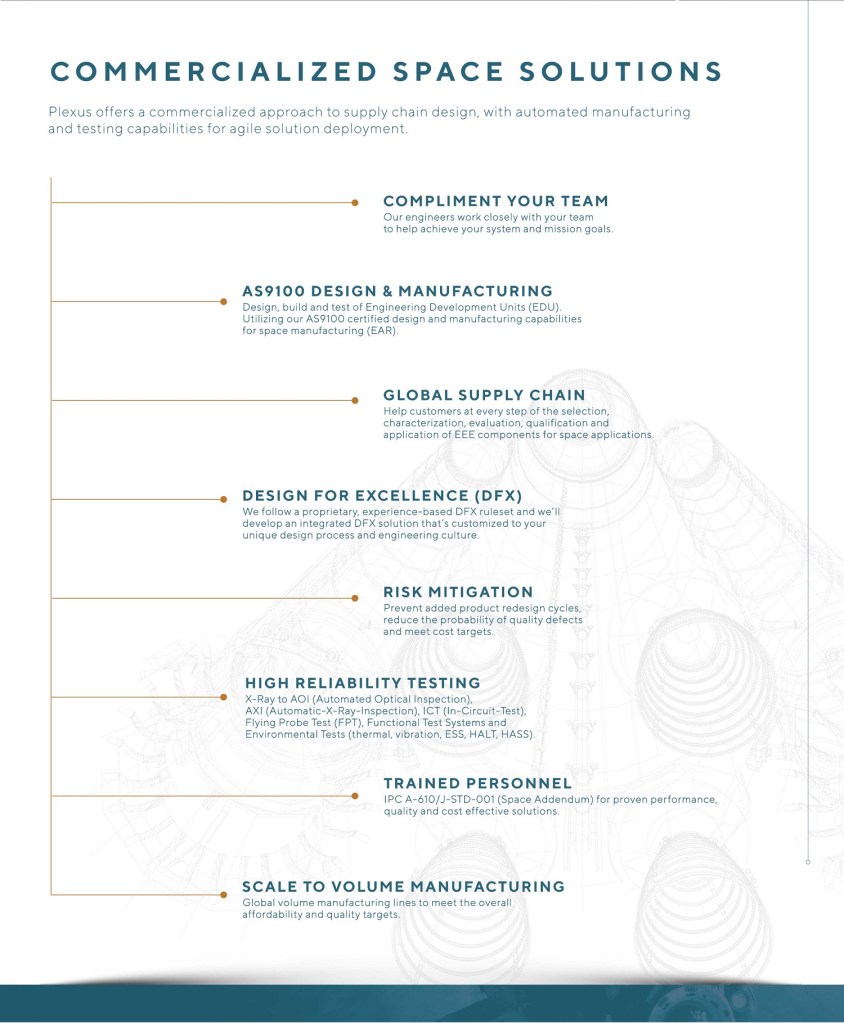

With over 40 years of experience in integrated design, engineering and manufacturing support, Plexus is an expert at integrating complex product designs with stringent requirements – to achieve lower cost components, manufacturability and higher volume manufacturing. We offer our customers a commercialized approach to supply chain design, with automated manufacturing and testing capabilities and global resources for agile solution deployment. Plexus is built to meet the complex requirements of the space industry and has become a crucial partner for many companies in the industry when developing and manufacturing highly sophisticated satellites and bringing them to the market in a cost and time efficient way.

The journey from GEO to LEO begins as early as in the design process.

If a customer, for example, has an existing GEO satellite, our engineers work closely with their teams and begin with reviewing possible alternative components and system solutions to meet the less stringent requirements of LEO. Electrical, Electronic and Electro-mechanical (EEE) components range from on-board processing, solar arrays and antennas to power- and thermal-management systems to modems, star tracker, propulsion and reaction wheels.

When designing for the GEO environment, parts need to fulfill certain requirements such as radiation hardening and various MIL-STD (United States Military Standards). Naturally, the produced quantity of these parts is much smaller than that of automotive or commercial components. And because of the higher diligence that goes into testing and inspection, the component costs are very high and the supply chain is more limited.

In the LEO environment, requirements for EEE parts differ, especially concerning radiation levels and the life cycle of the satellite itself. From a manufacturing and testing perspective, these less stringent requirements open the pool for more commercially available components at a lower cost – for example by utilizing the latest technologies from the automotive or industrial sector. Plexus’ cross-industry experience and worldwide supply chain expertise helps customers at every step of the selection, characterization, evaluation, qualification and application of EEE components for space applications. By carefully selecting and testing alternative parts and choosing suppliers that can ramp quickly from New Product Introduction (NPI) to production of standard and large form factor PCBAs, we can help reduce costs and get new LEO satellites in orbit as quickly as possible.

Getting it right the first time with Design for Excellence (DFX).

Design for Excellence (DFX) presents another huge opportunity in the design and development stage to reduce lifecycle costs of LEO satellites and optimize their manufacturability. Plexus’ dedicated services include risk mitigation to prevent added product redesign cycles, reduce the probability of quality defects and meet cost targets. We follow a proprietary, experience-based DFX ruleset and bring critical team players into the development cycle. This approach helps us to look at the product from a different perspective.

With the shift from GEO to LEO, this perspective is all about keeping cost down and moving to market quicker. Take testing, for example. While spending hundreds and thousands of hours examining a handful of boards for GEO might have been feasible in the past — with the higher production volume of LEO, manufacturers need to automate their test strategy for satellite and ground station PCBA’s for immediate system integration and deployment. In fact, scalability in manufacturing goes hand in hand with scalability of testing. Plexus has cost effective high reliability testing capabilities which are tailored to end use environment of space – from X-Ray to AOI (Automated Optical Inspection), AXI (Automatic-X-Ray-Inspection), ICT (In-Circuit-Test), Flying Probe Test (FPT), Functional Test Systems and Environmental Tests (thermal, vibration, ESS, HALT, HASS). By introducing these testing processes in a more automated, more organized fashion compared to what manufacturers usually have done in the past, we further can reduce costs and time to market and help them to scale form GEO to LEO.

From New Product Introduction (NPI) to volume satellite manufacturing.

In the end, managing the shift from GEO to LEO depends first and foremost on the ability to scale to volume production – from 2 to 5 hand built large systems to entire constellations of 10 to 25 thousand LEO satellites. Plexus utilizes its volume manufacturing lines (as opposed to the traditional more prototype or very low volume based manufacturing) to meet the overall affordability targets. For government programs, this roadmap usually runs to domestic capabilities as compliance is stricter and satellites are required to be built domestically. For commercial satellite applications, however, low cost region manufacturing solutions are a significant option to further reduce overall costs. Plexus has the unique compliance know how, manufacturing resources and practical experience to successfully transfer builds to a low cost region.

Another example of successfully going from New Product Introduction (NPI) to volume satellite manufacturing is the design, build and test of Engineering Development Units (EDU). This may involve hand building the flight hardware in our Design Centers and utilizing our AS9100 certified design and manufacturing capabilities for space manufacturing (EAR). Plexus can take over the upfront engineering work for our customers, giving them much needed time and resources to focus on their core competencies.

Besides established and reliable processes and on-site trained personnel (e.g., IPC A-610/J-STD-001 (Space Addendum)) for proven performance, quality and cost effective solutions, Plexus is also continuously innovating and utilizing its leading edge design experience for emerging technologies. For example, our team has been through a process of qualifying a Plexus conformal coating to Master Standard that protects the satellites’ very expensive PCBAs from external factors like radiation and temperature extremes that come with space. Instead of outsourcing the boards to another facility, Plexus is able to do the coating internally – thereby reducing the risk of handling as well as improving the overall lead time.

Staying competitive and innovative while also cutting costs and fastening time to market will always be a difficult undertaking. The space industry is no exception. If large LEO-constellation providers want to make their prices competitive and achieve profitability and long-term viability, they won’t succeed by doing it all on their own. In fact, it requires close cooperation between development, supply chain and manufacturing, but also a strong partner with expertise, resources and industry specific experience along the value chain. Together, companies can get into position for the new space race, transform both the B2C and B2B communications markets and leave their footprint on earth and beyond.

- A new space race driven by government ventures and commercial interest.

- The technological shift: from large systems to satellite constellations.

- With LEO, cost is key to ensure profitability and long-term viability.

- The journey from GEO to LEO begins as early as in the design process.

- Getting it right the first time with Design for Excellence (DFX).

- From New Product Introduction (NPI) to volume satellite manufacturing.